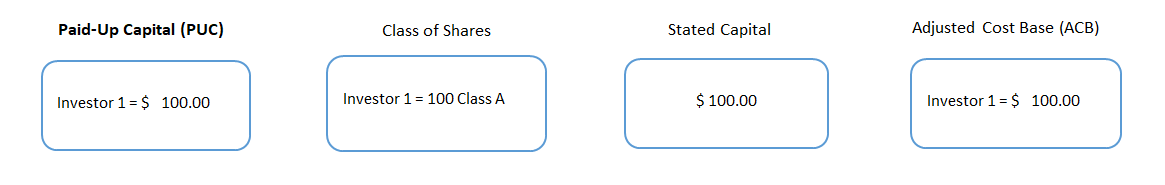

Paid-Up Capital (PUC) is basically the amount of consideration received by the corporation on the issue of the shares and may be further adjusted under subsection 89(1) of the Income Tax Act (ITA).

For example, an initial investor/shareholder subscribes 100 Class A shares in a corporation capital for $100.00.

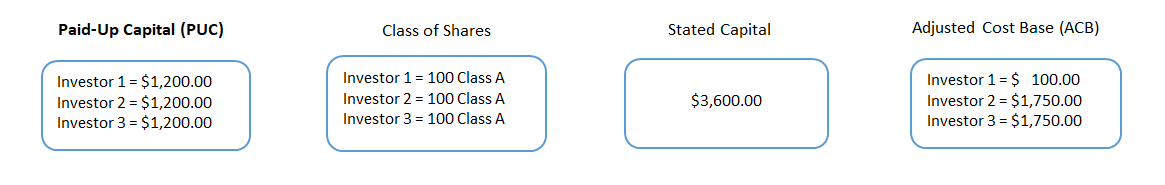

Business grows in a few years, the corporation takes on two new investors. Investor 2 subscribes 100 Class A shares for $1,750.00, and Investor 3 subscribes 100 Class A shares for $1,750.00.

The PUC per share increases to $12.00 ($3,600.00 / 300 Class A shares). Initial investor, Investor 1, is benefited from averaging rule; the PUC increases from $100 to $1,200.

Investor 2 and Investor 3 realize their tax-free return of capitals are being split. To avoid PUC averaging rule, Investor 2 and Investor 3 should subscribe to different Class of shares.

Please feel free to contact Terry.