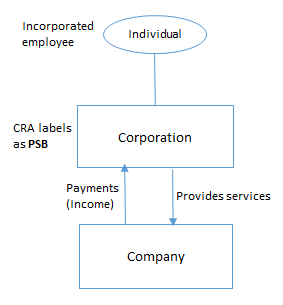

A PSB is defined in subsection 125(7) of the Income Tax Act (ITA):

- Individual performs services on behalf of the Corporation

- Individual is an incorporated employee or any person related to the incorporated employee is a specified shareholder of the Corporation

- Individual would reasonably be regarded as an employee of the Company to which the services were provided but for the existence of the Corporation

- Excludes Corporation that employs more than 5 full-time employees

- Excludes the amount paid to the Corporation for the services is received by it from an associated corporation

Taxation Years Before October 31, 2011

PSB enjoys the following tax savings:

- Claims Small Business Deduction

- Income splitting

- Tax deferral, etc.

Taxation Years Beginning After October 31, 2011

PSB has the following tax consequences:

- Paragraph 18(1)(p) of the ITA restricts the deduction of expenses of a PSB:

- Salary/wage (No accrual) paid to an incorporated employee

- Cost of any benefit or allowance provided to an incorporated employee

- No other expenses such as office supplies, auto, advertising, etc. are allowed

- Not eligible for Small Business Deduction of 19%, subsection 125(1) of the ITA

- Not eligible for general rate reduction of 13%, subsection 123.4(1) of the ITA

- Increased of PSB of 5%, section 123.5 of the ITA

- Result in 45% tax rate (Federal and Alberta) for 2019

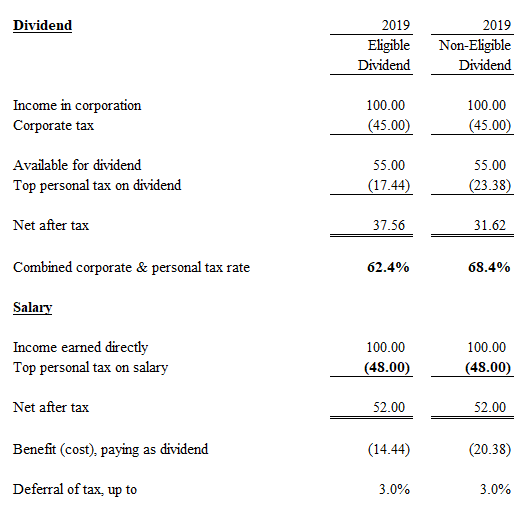

Therefore, an individual will pay significant tax when earning income in the Corporation (PSB) and paying it out as dividend compared to earning the same income directly. Further, tax deferral is small.

As illustrated below, top personal tax rate for earning income directly as salary is 48% compare to income earned in a Corporation (PSB) and distributed to an incorporated employee (Shareholder) as eligible dividend is 62.4% and 68.4% as non-eligible dividend. Tax deferral is only up to 3%.

Please feel free to contact Terry.