The government proposed changes to limit the preferential tax treatment of certain employee stock options by eliminating an offsetting deduction equal to one-half of the taxable benefit.

Before Taxation Year 2020

Canadian Controlled Private Corporation (CCPC)

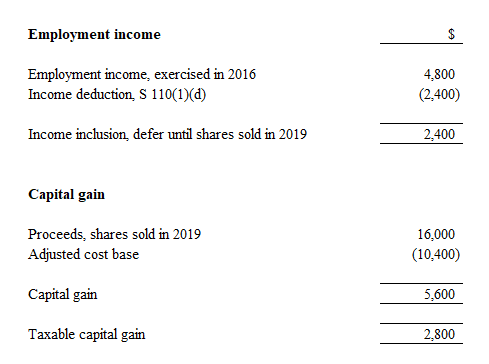

Generally, the employee can defer the employment benefit in the year the option is exercised until the shares are sold; the shares must be held at least two years.

The benefit is the difference between the fair market value of the shares and the exercise price. The employee can claim an offsetting deduction equal to one-half the benefit, if certain conditions are met.

For example:

In 2015, Y Ltd., a CCPC, offered key employees the option to buy 800 shares for $7.00 each. In 2016, the value of the share has increased to $13.00. Several employees exercised their options. In 2019, the fair market value of the share has increased to $20.00. Some of the employees decide to sell their shares. The benefit is calculated as follow:

Public Company

Generally, the employee has to report the employment benefit in the year the option is exercised.

The benefit is the difference between the fair market value of the shares and the exercise price. The employee can claim an offsetting deduction equal to one-half the benefit, if certain conditions are met.

After Taxation Year 2019

The proposed changes to the tax treatment of employee stock option rules to be effective starting January 1, 2020 has been delayed, more details will be announced in the 2020 Federal Budget.

Here is a summary of the proposed changes:

- A $200,000 annual cap on employee stock option grants.

- Stock options granted by CCPCs will be exempt from the new limit.

- Some non-CCPCs (Startups, emerging, or scale-up companies) will also be exempt from the new limit.

If the above are not met:

- There is no offsetting deduction equal to one-half of the taxable benefit.