Generally, taxpayers are required to include the value of work in progress (WIP) in computing their income for tax purposes. However, certain professionals (Accountants, lawyers, dentists, medical doctors, veterinarians, and chiropractors) may elect under Section 34 of the Income Tax Act to exclude the value of WIP in computing their income. In essence, professionals have tax advantages in deferring their taxes to later taxation years by deducting work in progress at year-end for tax purposes.

Effective for taxation years beginning after March 21, 2017, professionals are no longer have the option to elect to exclude their year-end WIP from taxable income.

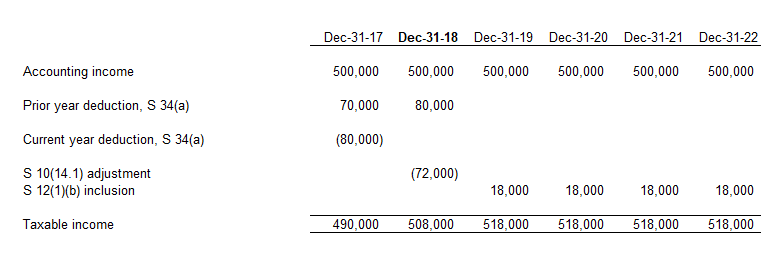

To mitigate the change, the legislation provides a 5-year phase-in period for the inclusion of work in progress into income.

For example:

ABC Corporation has a December 31 year-end and it earns $500,000 of accounting income during each of its 2017 to 2022. ABC Corporation has included in its income the WIP at year-end value at FMV, ITR 1801. The amount of WIP at the end of the year 2016, 2017, 2018, 2019, 2020, 2021 and 2022 was $70,000, $80,000, $90,000, $100,000, $90,000, $100,000 and $80,000 respectively.