In the 2018 Fall Economic Statement released on November 21, 2018, announces a new Accelerated Investment Incentive (AII). It allows businesses that acquire qualifying tangible assets (i.e. equipment, vehicles) and qualifying intangible assets (i.e. patents) after November 20, 2018 and available for use before 2028, be eligible for an enhanced first-year tax deduction.

To qualify, the following conditions must both be met:

- neither the taxpayer nor a non-arm’s-length person must have previously owned the property; and

- the property cannot have been transferred to the taxpayer on a tax-deferred “rollover” basis

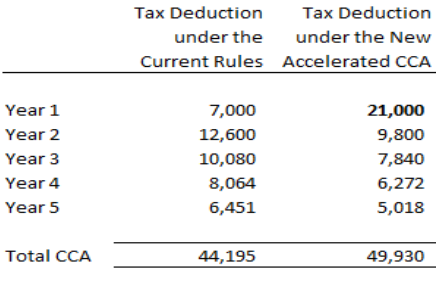

Therefore, businesses will be able to deduct up to three times the current first-year capital cost allowance or tax deduction. The Accelerated Investment Incentive property will be gradually phased out after 2024 until 2027.

For example:

A $70,000 equipment purchase that has a 20% CCA rate.

The new rules do not increase the total tax deduction, but allows a larger deduction in the first-year and will offset by smaller tax deductions available in future years.