Acquisition of control, S 256(5.1) of ITA, or change of control is basically the sale of a business through the sale or redemption of shares will result in one person controls the corporation.

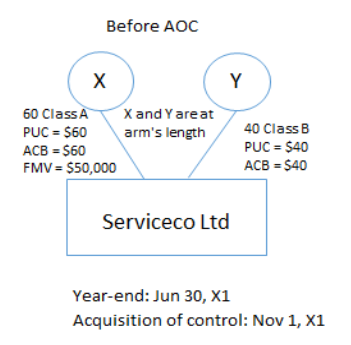

Assuming Serviceco Ltd is a Canadian Controlled Private Corporation (CCPC) and not a Qualified Small Business Corporation (QSBC). X and Y are at arm’s length. Serviceco Ltd has June 30, X1 year-end. Acquisition of control occurs on November 1, X1.

X has 60% and Y has 40% in Serviceco Ltd. After the sale or redemption of shares of X, Y will have 100% and control of Serviceco Ltd.

Tax Implications of a Corporation After AOC

Deemed Taxation Year-End, S 249(4)

The taxation year of the corporation is deemed to end immediately before that time. A new taxation year of the corporation is deemed to have commenced at that time.

From the above, there is a change of control on November 1, X1. Serviceco Ltd will have a deemed year-end as at October 31, X1. Serviceco Ltd will file short taxation year of 4 months from July 1, X1 to October 31, X1 and all the normal administrative requirements of a regular year-end.

Other rules can be found in the Income Tax Act (ITA): S 111(4) carryover of net capital losses, 111(5) carryover of non-capital losses, S 111(5.1) depreciable property.

Tax Implications of a Shareholder After AOC

It depends on the situation. If you sell your shares to another shareholder, the sale will result in a capital gain. If the corporation redeems your shares, the redemption will result in a deemed dividend.

Shares Sale Between Shareholders

Shares sale occurs when you sell your shares to another shareholder, in this case.

Shares sale will result in a capital gain and carry a more favourable tax rates. Only 50% of a capital gain is taxable.

From the above, X sold 60 Class A shares to Y for $50,000. The shares had an Adjusted Cost Base (ACB) of $60. As a result, X’s capital gain is $49,940.

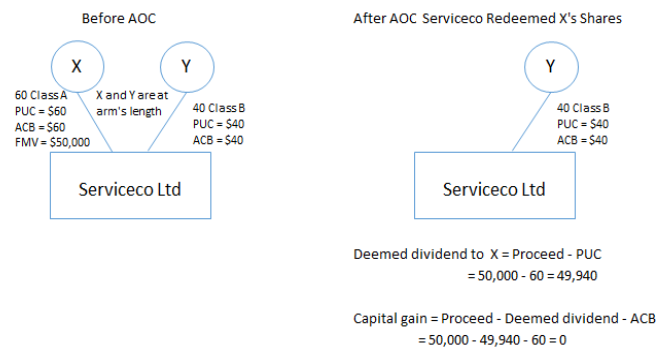

Shares Redemption, S 84(3)

Shares redemption occurs when a corporation redeems, acquires or cancels of its shares from a shareholder.

The redemption of share will result in a “deemed dividend”. A deemed dividend is basically a conventional dividend such as eligible dividend or non-eligible dividend. Dividends are taxed at higher rates than capital gains.

From the above, Serviceco Ltd redeemed X’s 60 Class A shares for $50,000. The shares had a Paid Up Capital (PUC) of $60 and X’s ACB was also $60. As a result, X received a deemed dividend of $49,940. And X’s capital gain is nil.