Updated May 2022

Tax integration is basically income earned by a corporation and distributed to shareholders as dividends is taxed approximately equal to income earned directly.

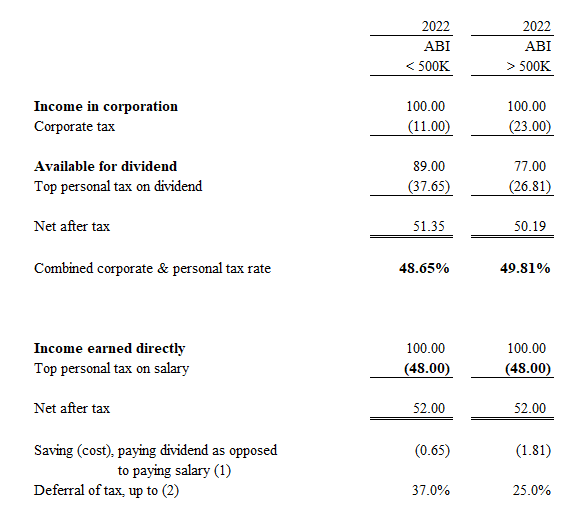

Example for Active Business Income (ABI) of a Canadian Controlled Private Corporation (CCPC) has a calendar year-end, combined Federal and Alberta corporate tax rates.

(1) Generally, there is marginally tax advantage to take salary over dividends for ABI < 500K. For ABI > 500K, there is tax advantage to take salary over dividends.

(2) We can retain income (funds) in the corporation and take advantage of the tax deferral.

The February 27, 2018 Federal Budget introduces two measures to reduce deferral tax advantages a CCPC earns passive investment income.

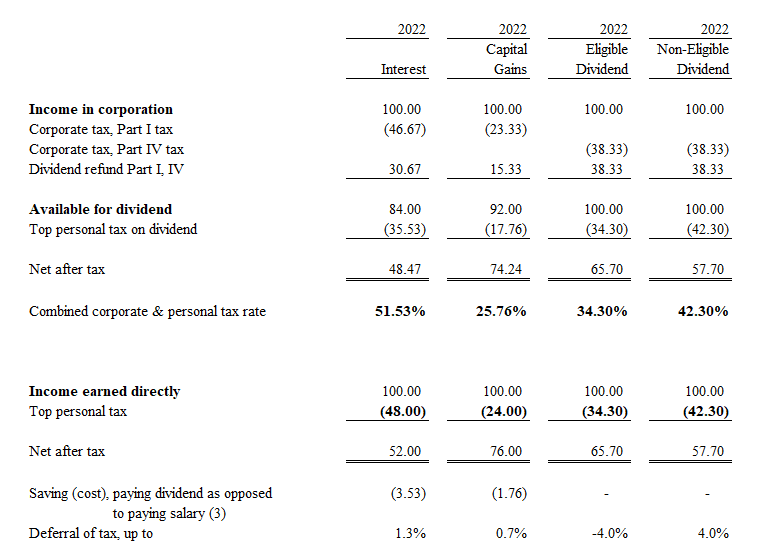

Example for Investment Income of a CCPC has a calendar year-end, combined Federal and Alberta corporate tax rates.

(3) Generally, there is no tax advantage to have investment income in the corporation.