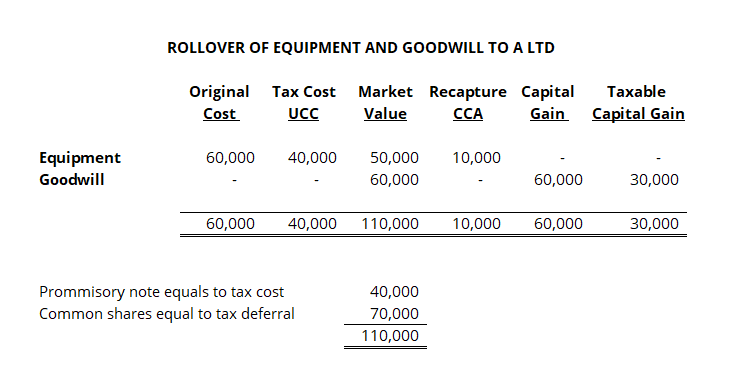

Once a sole proprietor decides to incorporate a sole proprietorship. There are tax implications for the conversion from a sole proprietor to a corporation. A transfer of assets from a sole proprietor to a corporation would be deemed disposition of assets at fair market value resulting in capital gains. However, under Section 85 of the Income Tax Act (ITA) allows a taxpayer to defer gains that are accrued on the assets transferred to a taxable Canadian corporation.

Conditions for a Section 85 transfer:

- Transferee must be a taxable Canadian corporation

- Consideration must include shares of the transferee corporation

- Property being transferred must be eligible property

- The transferor and transferee must jointly elect

For example:

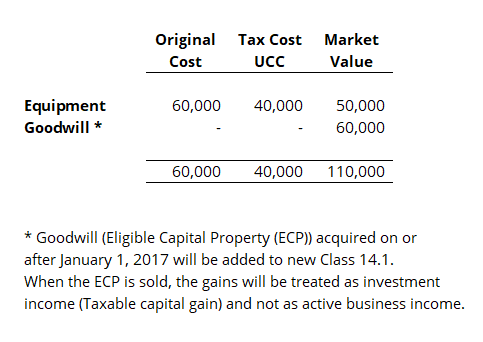

Mr. A transfers the following eligible property from his unincorporated (Proprietorship) to A Ltd.

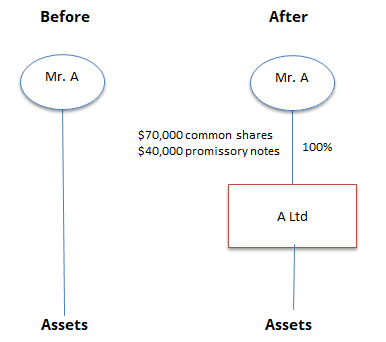

In exchange for his assets, Mr. A receives a promissory note and shares from A Ltd.

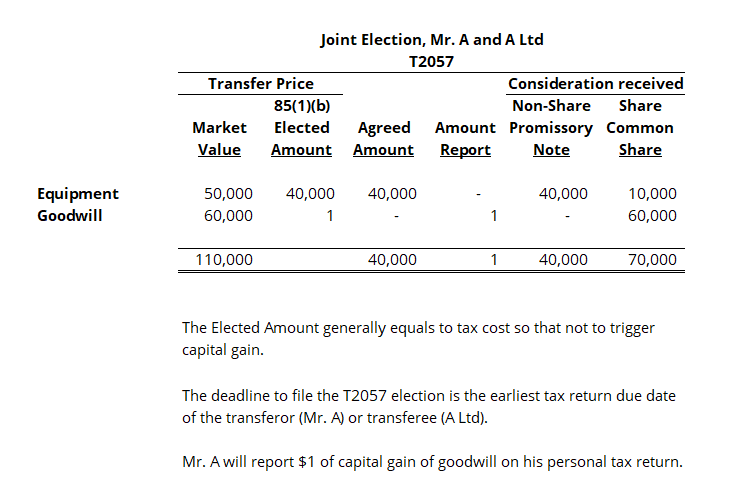

Mr. A and A Ltd file a joint election (Form T2057), due by the earliest date either party files an income tax return.