The small business deduction (SBD) is a tax rate reduction available to Canadian-Controlled Private Corporations (CCPCs) that earn on the first $500,000 of active business income in Canada. The combined Federal and Alberta for small business rate for 2017 is 12.5% versus the general corporate rate of 27%. The SBD is a tax deferral and not a tax savings due to integration, please refer to Tax Integration in Alberta.

Effective for fiscal years ending after March 21, 2017, the new Specified Corporate Income (SCI) rules prevent the use of certain corporate structures to multiply access to the SBD.

Specified corporate income defines under the new Subsection 125(7) of the Income Tax Act. Basically, if a CCPC (Co A) receives more than 10% of its income from another CCPC (Co B), then that income may be SCI and is not eligible for the small business deduction if there is a non-arm’s length shareholder.

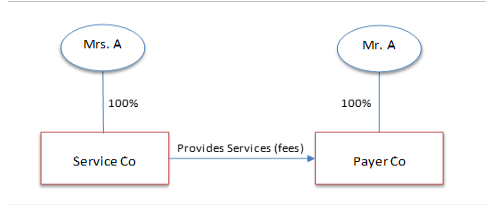

For example:

Mrs. A owns 100% of Service Co, and Mr. A owns 100% of Payer Co. Service Co provides services (fees) to Payer Co.

Under the old rules:

Service Co and Payer Co are related under S 251(2); however, Service Co and Payer Co are not associated under S 256. Therefore, fees paid by Payer Co to Service Co would be eligible for SBD. Thus, Service Co and Payer Co claim their own SBD.

Under the new rules:

Service Co received fees from Payer Co, and a shareholder of Payer Co does not deal at arm’s length with Service Co. Therefore, the fees would be considered specified corporate income and would not be eligible for SBD, unless Service Co received less than 10% of its fees from Payer Co.